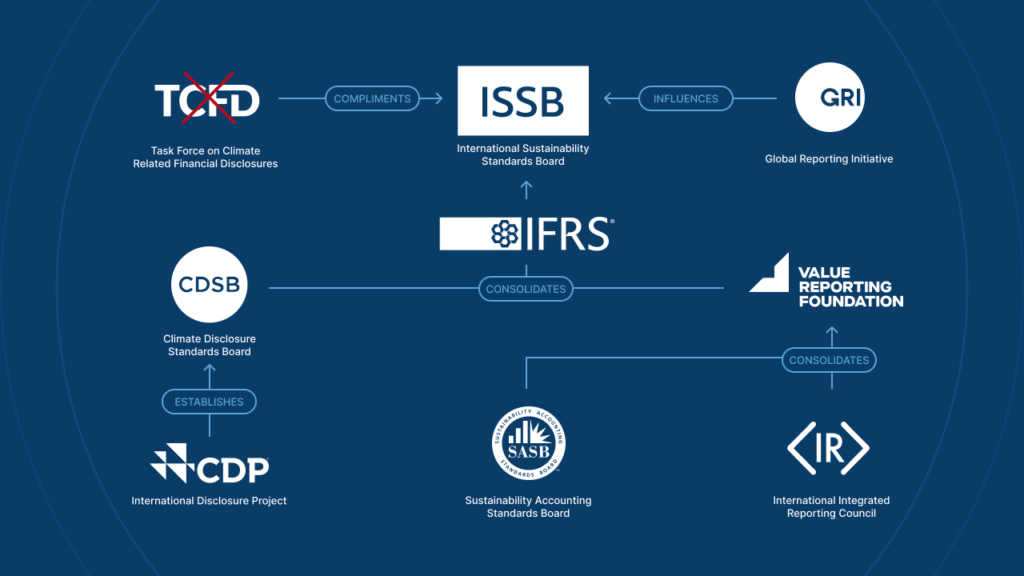

The narrative of standardized reporting will evolve with a significant step in 2024. The Financial Stability Board (FSB) and the IFRS announced a major transition at COP28: the Task Force on Climate-related Financial Disclosures (TCFD) is concluding its mission, passing the torch to the International Sustainability Standards Board (ISSB). This shift responds to the growing demand for clarity and accountability in reporting environmental and social metrics, an endeavor that TCFD has championed since 2015.

Following the issuance of the ISSB Standards—IFRS S1 and IFRS S2—the FSB has designated the IFRS Foundation to oversee the widespread adoption and diligent implementation of these essential disclosures.

Let’s explore into the expected integration of established frameworks into ISSB’s agenda for 2024:

- ISSB’s Directive: Assuming the TCFD’s legacy, ISSB aims to present a comprehensive reporting framework for environmental and social metrics, highlighting the concept of double materiality, which compels organizations to disclose information on aspects influencing financial performance and their broader societal and environmental impacts.

- SASB Assimilation: ISSB plans to integrate SASB’s industry-focused standards and its analytical framework. Entities are encouraged to adhere to SASB Standards during the transition to the new IFRS Sustainability Disclosure Standards.

- Contribution of IR: The principles of Integrated Reporting will be woven into ISSB’s initiatives, offering a framework that supports organizations in reporting comprehensive information on their operational strategies, governance, and their influence on value creation.

- Role of CDP: The ISSB will draw upon CDP’s profound knowledge in environmental data reporting, adopting its technical guidance to shape the ISSB Sustainability Disclosure Standards.

- GRI’s Complementary Function: In parallel, the GRI will continue to provide a broader perspective on sustainability impacts. A memorandum of understanding between ISSB and GRI solidifies their collaborative approach, ensuring that while ISSB focuses on financial materiality, GRI addresses the wider implications of corporate conduct on society and the environment.

This collaborative push for a standardized framework under ISSB’s governance aspires to yield more uniform, reliable, and comparable data on environmental and human capital metrics. This evolution is expected to fortify investor confidence and reinforce the resilience and integrity of the international financial market.

If you’re navigating the complexities of the new reporting frameworks or interested in understanding these insights further, connect with Harmony’s team.