Close

Harmony Analytics provides an integrated approach to manage risks and leverage opportunities.

Harmony Analytics is a leading data analytics firm that focuses on identifying and measuring companies’ risks and opportunities through data collection and contextualization.

The Harmony platform delivers valuable insights into a company’s profile, enhances transparency, and supports proactive risk management. By combining a research-based approach with advanced technology, we empower our ecosystem to make informed decisions that lead to better results.

At Harmony Analytics, we are dedicated to our partners’ success. We harness the power of data and technology to help them achieve their goals.

Harmony’s team is comprised of industry-leading data scientists, engineers and top of the line developers. Harmony’s technical team draws on decades of experience sourcing and standardizing data, building statistical models, and utilizing advanced computer science techniques to produce industry leading analytics.

Whether you seek to understand your portfolio’s risk profile, report on key metrics, or drive positive change, Harmony’s team is committed to delivering a customized solution that meets your needs. Contact us today to learn more about how Harmony can help your organization achieve its goals.

Harmony works with NGOs and Research Institutions

Hear how data can drive better investment decisions from Harmony’s research partners.

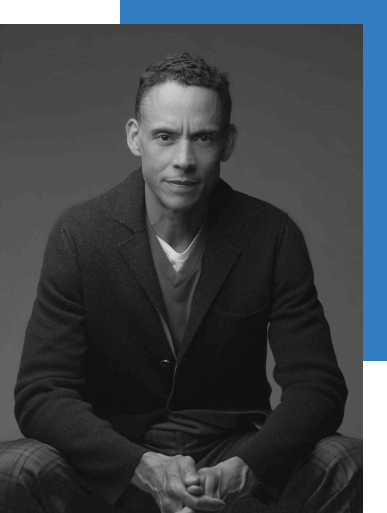

Founded by Paul Viera, a seasoned leader in the global investment space with over 30 years in global asset management, Harmony Analytics emerged from the frustration with the existing investment analytics. Traditional evaluations, relying solely on balance sheet and income statements, often overlook latent assets and liabilities critical for long-term corporate success. Available solutions fell short with opaque methodologies, lack of standardization, and a reliance on qualitative assessments that are subject to analyst biases.

Harmony Analytics overcomes these challenges by offering a platform that not only delves beyond surface-level financial data, but also contextualizes this data and empowers investors with valuable insights. Our dedicated team of experts prioritizes accuracy, and comparability in all our endeavors. Join us in our mission to elevate decision-making through data and Change How the World Wins™.

Paul Viera

Founder and CEO at Harmony Analytics